Escalade Stock: A Sporting Goods Powerhouse With Strong Growth Potential (NASDAQ:ESCA)

LPETTET/E+ via Getty Images

investment work

With fiscal 2022 results not at their worst, I wanted to see if there was an opportunity for a long-term investment in Escalade Inc (NASDAQ: ESCA). With the reduction of stocks in the foreground That the company can succeed in delivering better free cash flow over the next several years, coupled with its prioritization of deleveraging, also shows management in a good light, which in itself warrants another look at the company. I decided to model a DCF model where free cash flow improves over time and revenue falls over the next few years due to a supposedly imminent recession. Taking all revenue growth assumptions and other factors into account, the company is a Buy at these current levels, however caution is warranted due to the unknown global macro environment.

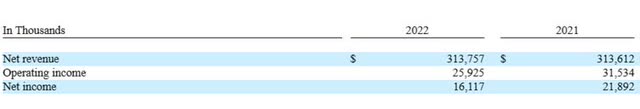

Fiscal year 2022

Revenue was flat, operations and net income declined during the year primarily due to slowing consumer demand and excess inventory in the retail channel. The company has also faced supply chain disruptions and higher freight costs, which have impacted its margins. However, the company was able to offset some of these challenges by acquiring new brands and expanding its e-commerce presence.

Due to supply chain issues, the company has been buying up additional inventory to accommodate this. However, the company isn’t happy with the amount of inventory it has left to sell, which impacted its operating results in 2022 and could continue into the future if it weren’t able to bring it down. Management reduced inventories by 13 million in the fourth quarter, which bodes well. Revenue is falling back to more normalized levels from pandemic-driven consumer demand. Does that mean the company will see a decline in sales for the next few years? Time will tell, but in my model I included some sort of reduction. Of course, its EBITDA number was also down year over year, coming in at $32.5 million in 2022 compared to $36.9 million in 2021.

Sales and Earnings Figures (Escalade Inc IR website)

growth catalysts

Management is looking to expand its e-commerce platform so it can become more efficient at selling directly to consumers. I like this idea because it means they want to be less dependent on third parties. I had a small complaint that over 35% of total revenue has come from two clients for quite some time. The company hasn’t mentioned who they are, but when we go back to FY21 results, they state that the top two contributors to revenue, by similar percentages, were Amazon Inc (AMZN) and DICK’S Sporting Goods (DKS). I daresay this hasn’t changed from year to year. I’m not saying Amazon or DKS will go out of business any time soon, but it’s better not to rely on one customer for such a large percentage of total sales. The e-commerce revenue segment was flat year-over-year, while bulk merchants saw sales decline.

Escalade Inc expects to benefit from continued consumer demand for health and wellness products, particularly in the fitness, archery and basketball categories. The company also plans to invest in product innovation, digital marketing, e-commerce capabilities and operational efficiencies to improve its competitive position and profitability.

It seems to me that the company might be able to continue the move to e-commerce direct to consumers, and if they can also sell their wares through Amazon and other partners, it can only mean better margins and more money for the company .

The company is also open to further acquisitions in the future to increase revenue. Most recently, they added Brunswick Billiards to their broad product portfolio.

pickle ball

One very interesting metric I found during my research was Pickleball’s explosive popularity in the US. The number of players in 2021 was 4.8 million, and in August 2022 this number reached 36 million people! That’s a massive increase and could give the company an extra boost in revenue going forward as they offer one of the leading pickleball paddles of the moment – the Onix paddle which has received great reviews and has grown in popularity.

The pickleball market size was about $153 million in 2021 and is expected to grow about 7.7% CAGR through 2028, which is $287 million if my math is right.

The above market size figures are for the US only. The size of the global pickleball market is estimated at US$1.3 billion and is projected to grow at a CAGR of 10.19% through 2028, resulting in a market valuation of US$2.37 billion. As Escalade is one of the leading suppliers of paddles, they stand a good chance of catching a good chunk of the growth in this market. Just a quick Amazon search for premium paddles reveals that the Onix paddle is one of the top rated with the second most reviews behind the Niupipo paddle.

I’m not sure how much of that market Escalade can capture, but even 1% of the 2028 figure equals $23.7 million. The company unfortunately doesn’t release any details on how much revenue it’s getting from this segment, maybe in the future.

finance

The elephant in the room, the huge mountain of debt on the books, has analysts concerned that a high leverage ratio and interest expense could limit the company’s profitability and financial flexibility going forward. I don’t like debt either, but I believe the debt the company has taken on to fund its acquisitions of Rave Sports, Victory Tailgate, and Brunswick Billiards over the past few years was a wise decision. We’ll have to wait for these results to appear in the future. Management also said it would prioritize further deleveraging. In the last quarter of 2022, the company managed to sell $13 million of its inventory while reducing its debt by $12 million. So I don’t think debt will be a huge deterrent for investors. The company aims for a net leverage ratio of 1.5x to 2.5x EBITDA, currently it is 2.7x.

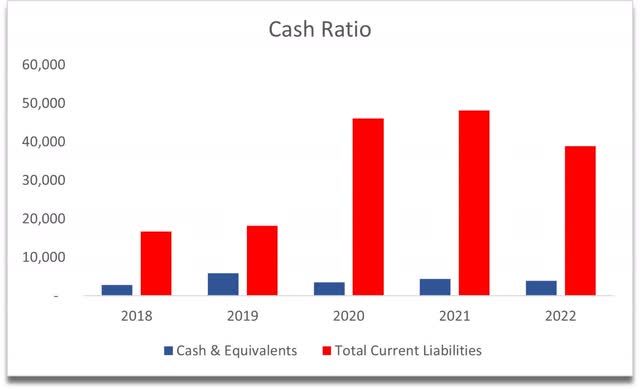

The cash ratio is a much more rigorous metric that many investors like to use, measuring how well the company can fund its short-term obligations with cash. The company wouldn’t pass that metric, however, if you just look at some of the company’s competitors, Escalade isn’t an outlier here either.

Liquidity ratio (own calculations)

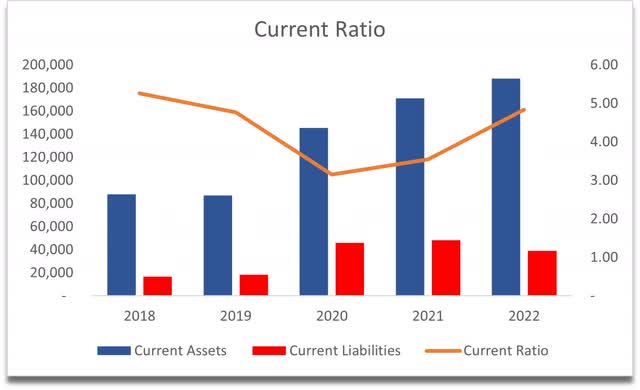

If we want to be less harsh on liquidity metrics, the company has a very good liquidity metric and it looks like it has moved up to 4.8 from a 2020 low of 3.16, which was still very good 2022 recovered The company is liquid and I don’t see anything that would tell me otherwise.

Current ratio (own calculations)

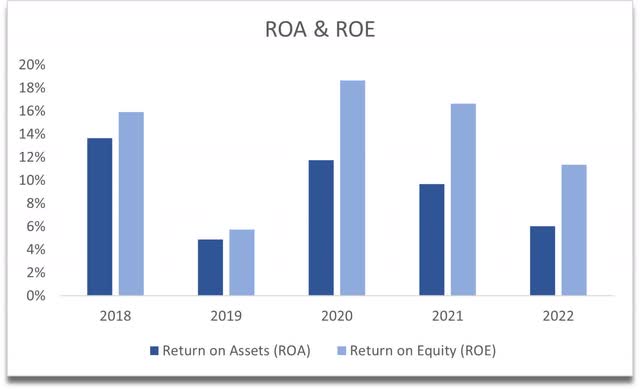

Return on investment and equity are also respectable, however these metrics have been trending down over the last 3 years. I would like them to stabilize or increase in the near future. This downtrend can be explained by the boom in demand during the pandemic, and the metric is just returning to normal levels.

ROA and ROE (own calculations)

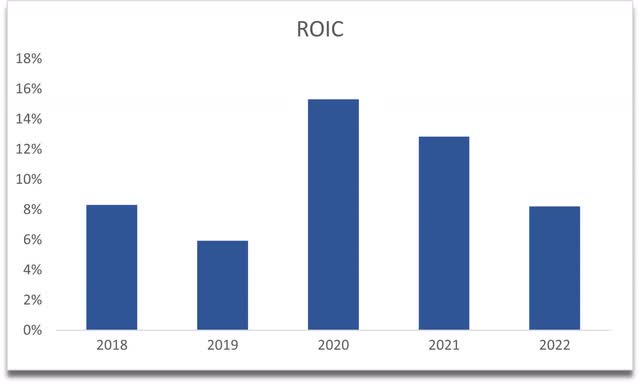

The return on invested capital is showing a similar trend down to normalized pre-pandemic levels. The yield is still good, but I would like to see an upward trend again in the future.

ROIC (own calculations)

DCF rating

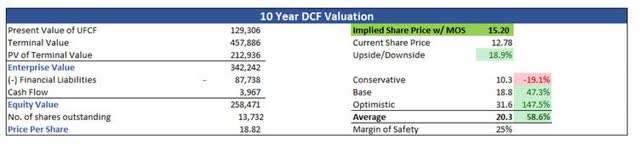

For my model, I decided to take a look at how the company’s performance would be affected by accounting for a recession over the next 12-24 months. For the worst case scenario, revenue will decrease by 10% for 2023 and 2024 and 7% for 2025 and then return to 10% growth for the next 2 years, 8 for the next 2, 6%, 5%, and 2 % for the rest of the years. I took these numbers because over the last 10 years it has only had a 1 year sales decline and it was barely 1%, but if we go back to the financial crisis, the company had a 20% sales decline per year for only 2 years in a row bouncing back, so -10% for the next 2 years and -7% for the third year seems a good indicator of some kind of recession, which may not be as bad as 2008. That’s what the Fed is saying. These estimates give me an average growth of 2% per year.

For my base case, I assumed sales would fall 2% in 2023 and 2024 and then bounced back and normalized, giving me an average growth of 4% per year. For the optimistic case, I assumed average growth of 6% per year for the next 10 years. I kept margins at about the same level as the company currently does, with the optimistic case having a 1% increase in profitability margins and the worst case having a 1% loss. The bezels are very tight so there isn’t much room to play around.

In addition to what I consider to be fairly conservative assumptions, I added a 25% margin of safety to the company’s final implied share price to give me a fair value of $15.20 per share, meaning the company is trading at a discount, if you believe the assumptions I have set forth.

10 years DCF (own calculations)

Diploma

Overall, I think the company is well positioned to reward its shareholders over the long term. Solid acquisitions will add value to shareholders, and if they can reduce inventories, deleverage, and generate good cash flows, I think the company is a long-term buy. There are a few factors that need to be considered before starting a new position or expanding the current position. One of the big factors to consider is a recession. Are we going to see a major downturn in the economy very soon? Will it not be as bad, or will it be as bad or even worse than 2008? If that happens, then my model hasn’t accounted for a massive drop in demand for sporting goods and may be invalidated. Patience might be the issue here, but I wouldn’t mind opening a small position and seeing where the economy goes over the next year or two.