Logitech: Long-Term Growth Reaffirmed With Latest Analyst Day (NASDAQ:LOGI)

Araya Doheny/Getty Images Entertainment

Summary

Post Logitech (NASDAQ:LOGI) on the most recent analyst day, despite some concerns about the company’s near-term performance due to a potentially weaker-than-expected 2FH24, I issued a “cautiously optimistic” view on the stock, but I stand by it long-term positive (on a pre-Covid trend line). Given the many positive takeaways I’ve gleaned from the last update, I recommend a buy recommendation with a cautious look at 2FH24.

video conferencing

March 23 Analyst Day

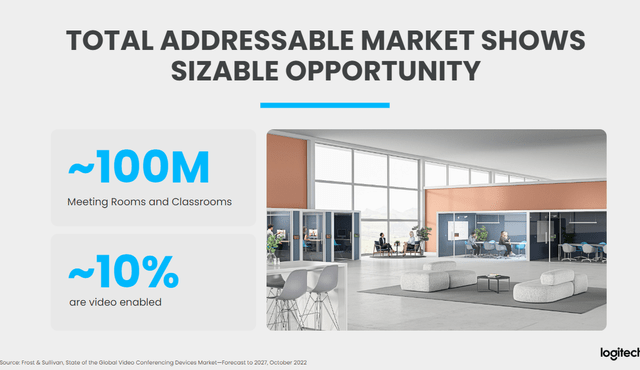

According to management, enterprise customers are being conservative with their spending and deferring decisions to later quarters, which has kept the video collaboration business weak. I think this is especially true given the recent layoffs and cost-cutting initiatives implemented by a number of large companies. However, I see these challenges as short-lived and anticipate that LOGI will continue to grow at a rate faster in the long term due to the extremely large addressable market. Additionally, I think the long-term growth prospects will be bolstered by a shift in customer preferences. I expect faster upgrade cycles as users seek more features and advances in hardware allow for more frequent technology upgrades by the company. New mounting options for things like whiteboards show promise for increasing the overall gain any space can achieve. Overall, Logitech has doubled its revenue per room over the past few years, and I expect that trend to continue as the huge price differential between Logitech and some of its competitors’ solutions continues to widen.

Gaming should help with long-term growth

March 23 Analyst Day

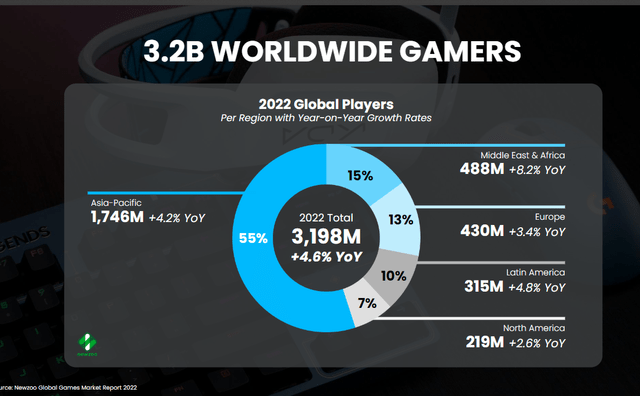

Based on numbers from LOGI Investors Day, the global gaming population is estimated at around 3.2 billion and is expected to continue growing in the low to mid single digits (I estimate this at ~4% using last year’s growth rate). Despite the recent macroeconomic challenges faced by the gaming industry, I believe LOGI is in a favorable position to capitalize on the ongoing trend of growing interest in gaming and its diverse range of products. Additionally, I anticipate that the launch of LOGI cloud gaming peripherals will significantly expand the addressable market as they launch the cloud streaming gaming service. In addition, Logitech may benefit from the growth prospects in the content creation market as the increasing number of users leads to an increased need for Logitech’s hardware and software products.

March 23 Analyst Day

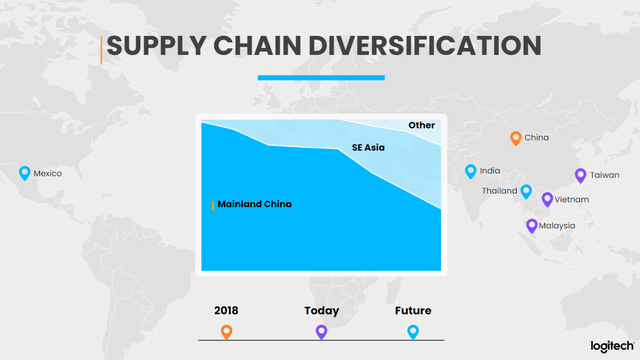

inventory and margins

It’s encouraging to see that management is working internally to reduce inventories after deliberately building up to meet rising demand during the pandemic. I see inventories steadily declining for the past three quarters and I believe channel inventories are at manageable levels. In my opinion, the company’s adaptive approach to managing operating expenses and inventory during the transition period will put it in a strong position to reap the benefits of margin expansion once growth resumes. Last but not least, I would like to point out that LOGI has already automated about 75% of the operation of its own factory and is on the way to move production capacity outside of China. In my opinion, these actions will help the company avoid the supply chain disruptions that have plagued it in recent months. Long-term revenue increases will also translate to improved gross margins through factors such as declining freight costs, a shift in product mix toward video conferencing, and the ability to lift fixed costs.

March 23 Analyst Day

guidance

While management only provided guidance for 1FH24’s revenue and operating income due to a lack of transparency, normal seasonality suggests that FY24 revenue will decline in the low double digits on an annualized basis and FY24 operating income at around 400+ million US dollars will be. The result would be a revenue and operating income trend line for LOGI that is relatively close to that pre-COVID. This forecast is great because it helped reframe investor expectations. However, my biggest concern is that management is only providing guidance based on the results of 1FH24. I understand that predicting the outcome of 2FH24 is a difficult task, but given that management only began to acknowledge the company’s weaknesses and the possibility of high channel inventory in the second half of January, it can be concluded that it is The growth rate of 2FH24 may not match the seasonal rate. Due to the uncertainty around 2FH24 I believe the stock will experience increased volatility until more clarity is provided.

Still, I believe Logitech’s continued investments in research and development will allow the company to maintain or increase its market share in key areas like video conferencing and gaming. In my opinion, once revenue growth picks up, LOGI will be in a strong position to leverage its operations thanks to its emphasis on cost control to offset some of the higher costs. Another piece of good news is that management has reaffirmed its commitment to the long-term goals of its business model.

Diploma

After the analyst day, despite some concerns about LOGI’s near-term performance due to possible weakness in the second half of 2024, I recommend a buy rating with a cautiously bullish view, taking into account the numerous positive insights from the update. The video collaboration business in particular could be weak due to cautious corporate spending, but I believe these headwinds are temporary and the business will grow at a rate faster than the group’s average growth rate. Logitech is also well positioned to capitalize on the long-term trend of increasing interest in gaming, and the launch of Logitech cloud gaming peripherals is expected to expand the addressable market. I also believe that Logitech’s continued investments in research and development will allow the company to maintain or increase its market share in key areas, and the company will be in a strong position to achieve operational leverage once revenue growth picks up. Overall, I see LOGI’s long-term growth prospects as positive.