More Rate Hikes to Come, According To Latest Fed Meeting Minutes – Here’s What That Means For Crypto

Further interest rate hikes will come from the US Federal Reserve. At least that was the finding from the recently published protocol of the 1stSt February Federal Open Market Committee (FOMC) meeting earlier this Wednesday. This could be a major headwind for crypto in the medium term.

The FOMC, made up of a number of Federal Reserve Governors and regional Fed Presidents, raised interest rates by 25 basis points to a target range of 4.50% to 4.75% at its meeting earlier this month. That was a deceleration after a 50 basis point rate hike at the last meeting in 2022, preceded by four consecutive 75 basis point hikes.

Minutes indicate that FOMC members believe that further rate hikes will be needed to ensure inflation sustains a return to the 2.0% target. “Almost all” FOMC members supported the deceleration on rate hikes of 25 basis points. “Upside risks to the inflation outlook remained a key factor shaping the policy outlook,” the minutes read, while some officials warned that an “insufficiently restrictive” stance could hamper progress on cutting inflation.

Hot US data forces markets to increase bets on Fed tightening

The latest release of Fed minutes comes after financial markets spent the past few weeks increasing their bets on Fed tightening. More specifically, most analysts were forecasting just two more 25 basis point hikes in late January — one at the February meeting, which was delivered, and a final one at the March meeting.

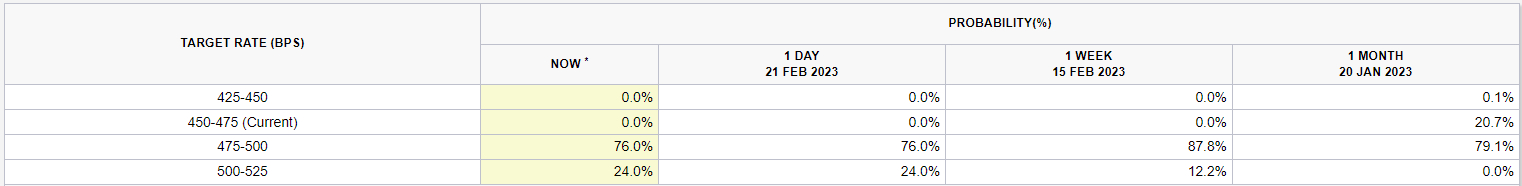

Some market participants were even betting that February’s 25 basis point hike could be the Fed’s last of the cycle. This was reflected in the fact that the money market implied probability that there would be no rate hike in March and rates would remain in the 4.50-4.75% range was around 20% according to CME data.

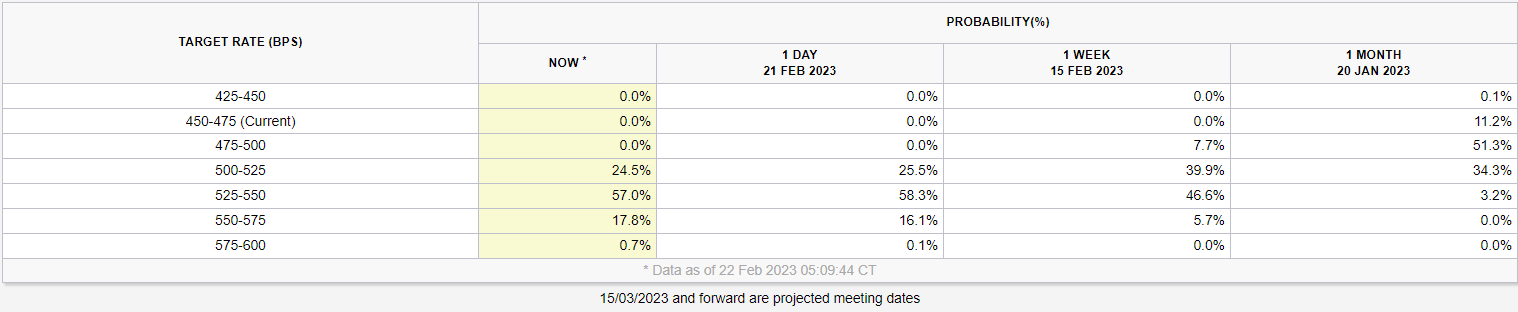

However, the string of stronger/hotter than expected US data releases this month, including the January jobs report, the CPI report and the results of the ISM PMI survey, has triggered a major shift in market expectations. With the US economy still humming nicely and inflation still too high to be comfortable, markets are now implying a 27% chance the Fed will cut rates by 50 basis points (to 5.25-5.25) next month 5.50%) could increase.

Meanwhile, interest rates are likely to peak in the 5.25-5.5% range in June, with money markets implying around a 30% chance that they will rise another 25 basis points by July to the 5.50-5.5% range. 75% will increase. This has led to a rally in the US Dollar Index (DXY) and US yields, particularly at the short end of the curve, and has weighed on US equities of late.

Crypto has rallied so far despite these macro headwinds – weaker stock prices, a stronger dollar and higher yields have historically weighed on crypto prices. But as the rally extends, some traders fear the risks of a correction are increasing.

Why Continued Fed Rate Hikes Can Hit Crypto

Crypto prices, especially the prices of big blue-chip names like Bitcoin and Ethereum, have had a pretty strong positive correlation to US stocks, especially big tech names, over the past few years. This correlation has weakened somewhat this year, with crypto far outperforming all major US stock indexes such as the S&P 500, the Nasdaq 100, and the Dow Jones Industrial Average.

However, since crypto is still in its infancy and is still viewed as a “risk asset” by most macro investors, the correlation is unlikely to completely collapse anytime soon. And that could be a problem for crypto in the future. That’s because the bear market that began in early 2022 may not be over yet.

Analysts at JP Morgan made some key observations in a note released earlier this week. US stock indexes like the S&P 500 have never bottomed before the end of the Fed’s tightening cycle, and usually only after the Fed has already made a series of rate cuts.

In other words, with the Fed still expecting three more rate hikes, it’s probably too early to bet US stocks have bottomed. The implication is that the S&P 500 and other major indices could soon be heading back to their 2022 lows printed last October.

A weak corporate earnings season in Q4 2022, strongly suggesting an earnings recession is looming in 2023, combined with an increasingly toxic interest rate outlook could certainly push equities lower in the near term. Until the outlook for US stocks improves, crypto traders should tone down the excitement. Perhaps the bottoms are in for this bear market – a litany of on-chain and technical indicators suggest – but the prospects for further upside remain bleak.