Record 9.62% I Bonds Rate Ends in October: How to Buy Savings Bonds

In May the inflation rate for Series I Savings Bonds reached an all-time high – 9.62%. This record-high rate lasts for six months, but time is running out to get it. The Treasury will announce the new floating rate for I-Bonds on November 1st and the last day to buy I-Bonds at the rate of 9.62% will be Friday October 28th.

Series I Savings Bonds have interest rates linked to inflation, meaning they pay more when inflation rises. While inflation has slowed in recent months, the forecast rate for the next six months is around 6%, which in itself is pretty good for a risk-free investment.

Unfortunately, TreasuryDirect — the requisite website for buying savings bonds — hasn’t responded well to the popularity of I-Bonds. After the record interest rate was announced in May, the resulting traffic caused the entire TreasuryDirect system to crash.

After a bit of frustration and persistence, I was able to navigate the TreasuryDirect system to buy my own I-Bond — and so can you. Read on for a detailed step-by-step guide on how to buy Series I savings bonds.

For more helpful information on low-risk investing, check out our high-yield checking accounts and best interest rates on CDs.

How do I buy I-Bonds?

I-Bonds are sold electronically through TreasuryDirect, and all Americans can buy up to $10,000 per year. Additional Paper I Bonds can be purchased using only your tax refund, up to $5,000 per year.

To buy Series I savings bonds electronically, you must first create an account with TreasuryDirect. Despite the site’s name, don’t expect the process to be easy, straightforward, or efficient.

The site looks like it was designed in 1998 when the Series I savings bonds were introduced. It has you jumping through a bunch of hoops to register and buy I-Bonds, but stick with it and you’ll get there. (Maybe.) I definitely recommend using a Laptop or writing desk instead of a phone browser.

- Visit TreasuryDirect.gov and click on the green one Open a bank account shortcut

- Under “Individual/Personal” click on the TreasuryDirect login link

- Review the information you need to open an account: social security number; Email-address; Bank account and routing numbers

- Click on the blue Apply now button

- Select the Custom radio button and click on it Submit

- Enter your personal information, including email address and bank details, and click Submit

- Check your information and click Submit

- Choose a personalized one picture and caption (security measure) and Submit

- Choose a password and answer three security questions (I suggest recording your answers somewhere) and Submit again

- TreasuryDirect will then email you Bank account number that’s a letter followed by nine numbers. Write down your account number.

- Go to the home page again and click the TreasuryDirect login linkand then click the orange registration button

- Enter the Bank account number that was emailed to you and met Submit

- As this is your first login, you will receive an email from TreasuryDirect again with a one-time passcode — check your email (and stay tuned!)

- Give her password and click “Register this computer” to avoid the one-time password on future logins

- Give her password. You can’t paste it. You can’t even type it! You must enter it with your mouse and a virtual keyboard (sorry fellow users of Password manager)

- Exhale – you are in

You need valid bank accounts and sort codes to sign up for TreasuryDirect.

TreasuryDirect/Screenshot by Peter Butler/CNET

Be warned: the site can be more than a little finicky. On my first click after registering, I was promptly kicked out with the message: “TreasuryDirect is not available. We apologize for the inconvenience and ask that you please try again later.”

I couldn’t log in for a few hours, but I finally did the task I came for – buying Series I savings bonds. Here’s how:

- After logging in, click Buy direct at the top of the page

- Under savings bondsclick the radio button for “Series I” and then click Submit

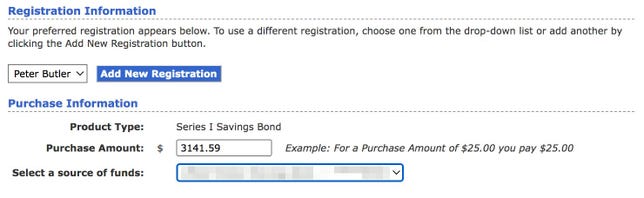

- On the BuyDirect page, enter the bond amount you want to buy, down to the cent $25 to $10,000.

- As a optional stepyou can set up recurring purchases of I-Bonds at different time intervals like weekly or monthly

- Confirm that your bank account information is correct and click Submit

- Review the terms of your purchase again and click Submit for one last time

You can buy I-Bonds in any exact amount over $25 and under $10,000.

TreasuryDirect/Screenshot by Peter Butler/CNET

You just bought an I-Bond!

Unsurprisingly, the result feels disappointing – you have to wait another business day for the bond to appear in your TreasuryDirect account. But then you can keep it or sell it (after a year) whenever you want.

How to buy an I-Bond for a child?

If you want to buy I-Bonds for a child, click on the blue Add new registration button on the Buy direct purchase page. Then create a linked “minor account” before completing your purchase by following the same registration steps as above.

Child accounts are custody accounts that can only be accessed by the primary account holder, i.e. the parent or adult who opened the account. You can also use the Add New Registration button to purchase Gift I Bonds for anyone eligible with a Social Security Number.

What About Buying Paper I Bonds?

You can only buy Paper IBonds when filing your tax return. You do this by completing IRS Form 8888, Allocation of Refunds, which is included with all of them Leading tax software.

You can allocate up to $5,000 a year in Paper I Bonds for two recipients — that could be you and your spouse, but it can be any two people. Your paper bonds will be shipped approximately three weeks after the IRS processes your return.

Paper I Bonds feature famous Americans such as Helen Keller and Dr. Martin Luther King Jr.

US Treasury Department

How can I cash out I-Bonds?

In order to cash out or redeem your electronic I-Bonds, you will need to re-login to TreasuryDirect. If you are on your “My Account” page:

- press the ManageDirect link at the top of the page

- Select the type of securities (savings bonds) that you want to redeem and click on Submit

- Select all of the individual I-Bonds you want to cash out (up to 50 at a time) and click Submit

- On the Redemption Request or Multiple Redemption Request page, select and click the destination for your money review

- Check your information and Submit to complete the redemption

- You’ve redeemed your bond(s) and your money is on its way

You can cash out Paper I-Bonds at most banks with physical branches, although your options are there fades.

If you don’t have access to personal banking, you can send your paper bonds to Treasury Retail Securities Services, PO Box 9150, Minneapolis, MN 55480-9150 along with FS Form 1522 from the Bureau of the Fiscal Service.

You still need to provide account and routing numbers to pay out a paper bond through the mail. If you don’t have a bank account, many Prepaid Debit Cards Add account and routing numbers to use with paper or electronic I-Bonds.

Keep in mind that you have to wait at least a year to cash out an I-Bond. If possible, it’s a good idea to wait five years or more to pay back that investment. If you cash in before five years are up, you’ll miss out on the last three months’ interest income.

For more low-risk investments, check out our lists of The best high-yield savings accounts and best cd prices.